Permissionless Market Creation

Anyone can create and fund share markets on Panana. There’s no approval step — a market goes live automatically once its minimum liquidity is provided.

Flow: Create → Provide → Trade

- Create – Write a clear prediction question, define category, end time, resolution rules, and sources. Our AI wil support you!

- Provide – Add liquidity yourself or let others fund the market. You can set a minimum liquidity requirement (e.g. 2 USD or higher).

- Trade – Once the total liquidity meets the minimum, the market is live and trading begins.

Markets are only tradable once they reach their minimum liquidity target. This ensures there’s enough depth for fair trading and accurate pricing.

Funding Logic

There are two main paths to make a market live:

1. Self-Funded Markets

If you add the full liquidity during creation:

- The market goes live instantly.

- You earn both creator fees and LP fees from trading volume.

- You can also take the first AMM price at 0.5, giving you an early position advantage.

2. Community-Funded Markets

If you add only partial or no liquidity:

- The market enters a Funding phase.

- Other liquidity providers (LPs) can add funds until the minimum is reached.

- If LPs consider the market “good,” they’ll fund it to earn LP fees.

- If no one funds it, the market never goes live.

This system naturally filters for high-quality markets that others find worth funding.

What Makes a Good Market

A well-structured market attracts liquidity, trading, and discussion. Consider the following points:

- Unique – Not a duplicate or near-duplicate of an existing market.

- Clear and unambiguous – One specific event, no combined conditions (AND/OR).

- Verifiable – Includes a clear, public primary source and a fallback.

- Sufficient duration – Enough time before the end date for discovery and trading.

- Controversial or uncertain – Topics with real debate and attention drive volume.

- Defined edge cases – Clarify what happens if events are delayed, canceled, or partially occur.

- Neutral wording – Avoid bias or loaded phrasing.

- Public data – Results must be verifiable by anyone.

Resolution Rules

Keep resolution rules short and precise. They should state:

- What counts as Yes and No.

- The deadline for the event to occur.

- The primary and fallback sources for verification.

- How delays or cancellations are handled.

Example:

“Resolves to Yes if the official U.S. Bureau of Labor Statistics reports CPI inflation above 4% for October 2025 by November 15, 2025. Primary source: BLS.gov. Fallback: Bloomberg or Reuters.”

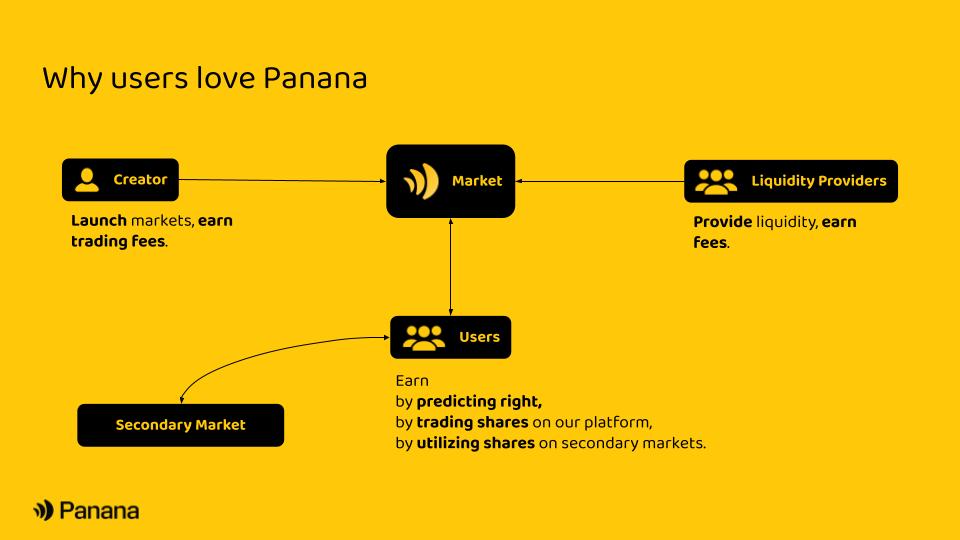

Roles and Incentives

-

Creators Earn creator fees on all trades. If you self-fund, you also earn LP fees and can buy first at 0.5.

-

Liquidity Providers (LPs) Earn LP fees proportional to your share of liquidity in active markets. Fund markets you believe will trade well.

-

Traders Trade shares to express opinions, hedge, or speculate. Traders drive market volume and fees.

Common Pitfalls

Avoid these to ensure your market gets funded and traded:

- Duplicate or too-similar questions.

- Vague or subjective wording.

- Timelines that are too short for discovery.

- Missing or weak resolution sources.

- Multi-condition (“if A and B”) questions.

- Topics with limited interest or unverifiable outcomes.

By following these principles, your market will have a higher chance of being funded, traded, and profitable — for you and for the liquidity providers who believe in it.